High Peaks Hospice announced that Phil Pekar, RN, its head of nursing, and Mel Duerr, RN, NP, its our clinical lead, have both earned their certified hospice and palliative care nursing certification.

High Peaks Hospice announced that Phil Pekar, RN, its head of nursing, and Mel Duerr, RN, NP, its our clinical lead, have both earned their certified hospice and palliative care nursing certification.

By earning this certification, they have proven competence and increased their knowledge across the spectrum of hospice and palliative care. The certification is a recognized quality marker by patients, physicians, providers, quality organizations, insurers, credentialers, and the federal government in an atmosphere of increasing awareness regarding quality in health care and appropriate utilization of services.

Woman Opens Barbershop In Fort Edward, Offering All Styles Of Cuts For Men, Boys

By Susan E. Campbell

A woman-owned, woman-run barbershop may be a rare thing, but a new one has come to Fort Edward.

Liv’s Broadway Barbershop opened at 128 Broadway on Nov. 15. It is the first business owned by Olivia Cabana, originally a resident of Queensbury and a trained barber for the past five years.

“I always wanted my own business,” said Cabana. “The last shop I worked for was privately owned by a good friend. I didn’t realize it was something I could do on my own.”

But after observing what it was like to have a business, Cabana thought it would be “a fun thing to do” as well as “a dream and a goal.” And so far, she said, “I am pleased with what I have accomplished.”

As a barber, Cabana does hair for boys and men, from a skin fade to an all-over scissors cut.

“The shop is not focused on haircuts for women,” she said.

Repeal Of Medical Device Tax Is Hailed As Relief For Many Businesses In The Region

The U.S. Senate passed legislation that includes a full repeal of the medical device tax — a 2.3 percent tax on a range of medical devices and products which previous research has shown to have minimal benefits for doctors, patients and manufacturers.

The medical device tax repeal provision was passed by the U.S. House of Representatives prior to the Senate vote.

The medical device industry is an important part of the Warren County economy.

EDC Warren County President/CEO Ed Bartholomew said “we are very pleased that an agreement has been reached to permanently eliminate the medical device excise tax which was scheduled to be reinstated on Jan. 1.”

‘Seafood On The Bay’ Opens In Glens Falls, Offers Louisiana-Style Cajun Cuisine

By Jill Nagy

On visits to Glens Falls, Tiffany Ni and her family noticed that the city’s lively restaurant scene still lacked a Louisiana-style Cajun seafood restaurant. So they created one.

Seafood on the Bay, at 21-27 Bay St., opened just before Christmas.

The space, formerly occupied by Superior Cantina, has been vacant for nearly two years. It needed a lot of cleaning up and “the change from Mexican to ocean” took some redecorating, Ni said.

The chef is Zong Xin, who has worked at other restaurants in the area. In addition, there is a staff of seven employees and, since the place is family-owned, “everybody helps.” There is seating for 100 people.

Business, so far, has been “so-so … A lot of people don’t know we are open,” said Jennie Zheng, an employee.

Warren Tire Service Center Plans To Open New Location In August, Its 16th Outlet In Region

Courtesy Warren Tire Service Center

By Jill Nagy

“We’ve always wanted to be in the Wilton-Saratoga area,” said Bob Kellogg, president of Warren Tire Service Center Inc.

That will happen in August, when he expects to open a 16th outlet at 573 Route 9 in Wilton.

Kellogg said the company has received all the necessary government approvals and recently began clearing ground and putting in foundations and the parking lot.

More extensive construction, by CGM Contracting of Waterford, is scheduled to begin in the spring.

The new facility will be a 6,300-square-foot building with eight service bays, as well as retail and wholesale space. It will be constructed on 5.83 acres across the Northway from the Wilton Mall, in the most southern part of Wilton.

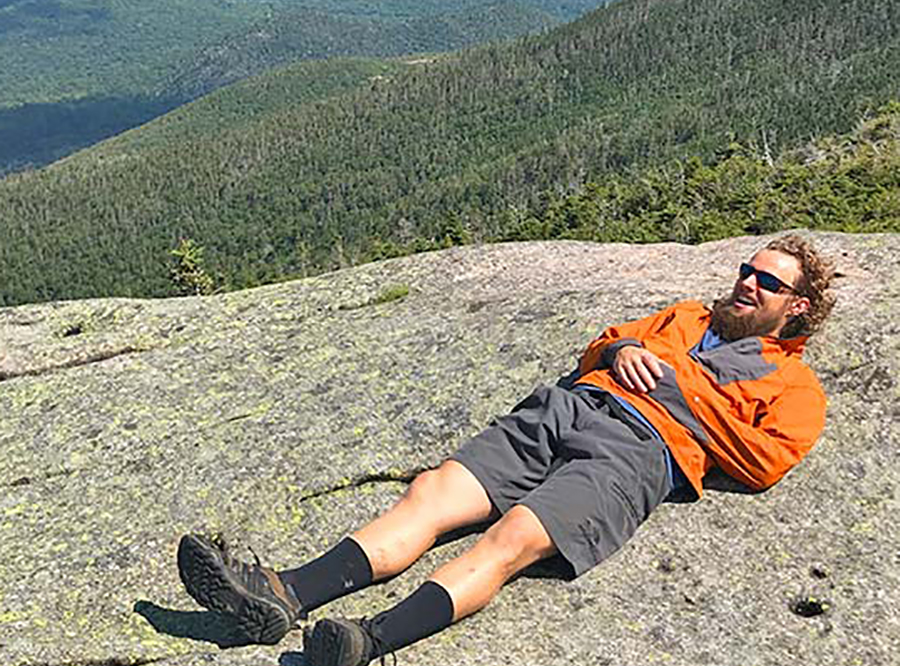

Lake George Native Starts A Business Taking People On Outdoor Tours Of Adirondacks

Courtesy Hiking with Jack

By Jennifer Farnsworth

Jackson Donnelly remembers when his love of hiking began. As a Lake George native, he said as a child taking hikes with his dad ignited his love and appreciation for the outdoors.

Today he is taking his connection to nature and turning it into a business called Hike With Jackson. He says anyone can learn the art of hiking and can do so in the beauty of the North Country.

“I’m excited to show others all the beauty of the Adirondacks that is right here in our backyard,” said Donnelly.

Hike With Jackson offers 20- to 30-minute hikes, half day hikes and full day hikes.

Donnelly is an accomplished hiker, including having ADK 46er on his resume, a title that stands for having completed hikes at the 46 peaks in the Adirondacks. He began those hikes while he was a freshman in high school. As a student at the University of Buffalo, he felt a noticeable void, not being out on the trails.

Axe Throwing Taught And Leagues Are Being Formed At ‘Adirondack Axe’ in Queensbury

By Andrea Harwood Palmer

A business that lets people participate in the sport of axe throwing has opened at 870 Route 9 in Queensbury.

Steve Greene and his wife, Kristen, opened Adirondack Axe in December.

“The response has been really positive,” said Greene. “We’ve had some repeat customers even in just the few weeks we’ve been open.”

Greene and his wife are originally from the area. They lived in Virginia for five worked he worked for the Great Escape theme park there.

Company Owners Should Develop Business Plans That Reflect Their Vision for Future

By Susan E. Campbell

As a new year arrives, many company owners review their business plans to make sure every financial decision, marketing program and staff member remain aligned with their company vision.

“Most of the time a business plan is stuck in a drawer and only revisited when the owner needs something, such as a loan,” said William Brigham, director of the Small Business Development Center of the University of Albany School of Business.

“We see a thousand businesses a year from 11 counties, and people would be surprised by the lack of a formal business plan,” said Brigham, who has been with the nonprofit organization for 20 years.

Financial advisors agree that a solid business plan is at the heart of a company’s success. Some aspects of the planning process are commonly overlooked or under-emphasized, according to local professionals who shared some tips for keeping companies on point, especially this time of year.

Business Report: Are Your Financial And Tax Advisers Talking?

By Meghan Murray

Now that we’ve closed the book on 2019, it’s officially tax season. As you prepare your tax returns for the April 15 deadline, you might already start looking for opportunities to improve your tax-related financial outcomes in the future.

One important step you can take is to connect your tax professional with your financial advisor.

Together, these professionals can help you take advantage of some valuable strategies:

• Roth vs. traditional IRA. If you’re eligible to contribute to a Roth IRA and a traditional IRA, you might find it beneficial to have your financial advisor talk to your tax professional about which is the better choice.

Generally, if you think your tax rate will be higher in retirement, you might want to contribute to the Roth IRA, which provides tax-free withdrawals (if you’re older than 59½ and have had your account at least five years).

New App Helps Manage Self Employment Taxes

For entrepreneurs and freelancers who struggle with quarterly taxes, help is here. AARP Foundation has launched AARP Foundation Self-Saver, an online resource and iOS app that enables the self-employed to anticipate and manage large expenses such as taxes.

Self-Saver is an all-in-one tool 1099 earners can rely on to calculate taxes, itemize expenses, automatically withhold the right amount of tax and submit quarterly filings to the IRS. The convenient, streamlined process makes it easy for users to get a handle on self-employment taxes.